Last Will and Testament

The cornerstone of your estate plan

Trust, Estate & Wills Lawyer in Towson and Hagerstown MD

The cornerstone of any estate plan is a last will and testament. Your last will and testament tells your family and the Maryland Register of Wills how to divide your assets when you die. But your Maryland Estate and Wills Attorney uses your last will and testament to do many things unrelated to your property. For instance, that document may contain information about who should take care of your children.

If you do not have a last will and testament, Maryland’s intestate laws determine how to divide your assets. Even scarier, the court will decide who will take care of your children without your input. Often, those intestate rules and court decisions would not be as you intended or ever wanted.

A Maryland wills lawyer at Rogyom Law can guide you as you decide how you would like your assets to be distributed. They can assist you with those many decisions that can benefit your family and loved ones for generations to come. We can help you create a custom-tailored last will and testament that gives your family much-needed certainty when they would normally have turned to you for guidance.

Why You Need a Respected Last Wills Attorney in Maryland

A last wills attorney specializing in estates can help you with:

Deciding the best structure for your last will and testament and estate plan

Determining whether you should include one or more Maryland trusts for your family

Planning for family members with special needs

Property distributing your business interests in an LLC or corporation

Changing the deed for real property or accounting for rental properties in your estate

Assisting with naming your personal representative, trustees, guardians, and others

Creating plans to minimize taxes, legal fees, and other expenses

Making sure your last will and testament is in a valid and legal form

A good Maryland estate planning attorney will also be able to spot hidden complex issues that need to be addressed or create planning opportunities. We will then make sure your wishes are being considered and save you from legal issues, business problems, or higher taxes.

Who Should Make a Last Will and Testament?

The most obvious reason for creating a last will and testament is to name who will receive your property after you die. That is just the beginning of what a last will and testament can do. Unfortunately, some wait until they’re older before creating a will.

While you may have more assets and feel it is more necessary later in life, there are many reasons to have a last will and testament when you are younger.

You are married and want your estate to belong only to your spouse

You have minor children

You have children or grandchildren with special needs

You would like your children to receive distributions over time

You own a business

Your estate needs to be planned to avoid family issues

You have specific requests for your burial or cremation

You do not want certain people to inherit your estate

You are married and want your estate to go to your spouse

Maryland intestate laws provide that if you are married, the only way your spouse will inherit your total estate would be if you have no living parents, siblings, or children. In all other cases, your spouse only receives a portion of your estate. This is not what most intend and most assume their spouse will receive everything.

You have minor children who need guardians

If you have minor children, then you want to ensure a person you trust will be your children’s guardian. You will also want the child’s share of the estate to be held in trust, rather than distributed without restriction to the child.

You have a child or grandchild with special needs

You would want to put any assets intended for that person into a special needs trust that will not affect their federal benefits.

You own a business

If your business is to survive, you will want to be sure you pass the business to a family member who wants to continue the business. If complications exist to passing the business, we need to put together a business succession plan that will comply with Maryland law. We need to protect its value and to benefit your family from its sale or transfer.

Your estate may cause family disputes

There can be disputes regarding how to divide your property, but there can also be conflicts over who is to be the personal representative, Maryland’s name for the executor. You can appoint your personal representative through your last will and testament and prevent those legal disputes.

You have concerns about taxes

Besides income and estate taxes, you may plan to avoid Maryland inheritance taxes. If we cannot avoid taxes, then you will want provisions in your wills to ensure they fairly divide taxes between those who receive probate and non-probate assets.

You have specific requests for burial or cremation

You can instruct your family on your funeral wishes. You can let them know if you prefer to be buried or cremated and inform them of your wishes regarding a particular cemetery or place your ashes should go.

You have people you really want to make sure don’t inherit by law

If there is someone you really don’t want to inherit your estate, you can specifically exclude them in your wills. This is a concern if Maryland’s intestate laws would, for instance, allow your parent that abandoned you to share your estate with your spouse. Note: I will refer you to another lawyer if you want to disinherit a child without a darn good reason. You hating their mom is not a good reason.

Ready to get started? We’re Ready to Help.

Contact us now and we’ll be happy to schedule a call or meeting with no commitment.

If we cannot assist you, we will gladly provide you with referrals.

An Overview of Creating a Will

Creating a last will and testament should be less complicated if you work with an experienced Maryland wills and trust attorney.

Get a Plan Outlining Your Wishes

When planning your last will and testament, you will want to consider several things:

Who do you want to inherit your property?

Who do you want to take care of your minor children?

Who do you want to be your estate’s personal representative?

Who do you want to handle other roles, such as trustee for any trusts you form?

You do not need to have each of these things completely decided before you speak to a good Maryland estate attorney. An experienced estate planning lawyer will guide you in making informed decisions and provide choices to fulfill your wishes.

Many times, clients come in with the exact plan they want but leave having made different choices. They learn about the law, the legal responsibilities, or learn about alternatives to meet their wishes. So, don’t overthink it. Starting the process to get your wills completed is your most important decision.

Drafting the last will and testament

Once we have worked together to get the plan for your estate completed, we will then draft your will to meet your wishes. We will also begin drafting other estate planning documents you will need. You will also likely create a financial power of attorney, medical power of attorney, and living will. We may also create trusts and re-title property as part of the process.

Signing your estate planning documents

While this sounds like a simple matter, properly signing the documents with witnesses and a notary is one of the most common reasons wills and other estate planning documents become unenforceable. Your Maryland trusts and estates attorney will make sure to properly execute all documents.

Making Changes to a Last Will and Testament

If you created your last will and testament in Maryland, you may change your existing documents. Many have multiple last wills and testaments throughout their life. You may choose to replace or update your existing last will and testament. Many update their will at the following events:

When you are first married

When you have children

When your children become older

When you approach retirement or your wealth changes

You may choose to update your last will and testament for many reasons, including:

To change your beneficiaries

To make bequests of specific assets

To change the shares of the beneficiaries

To change your personal representatives, trustees, or other roles

To account for changes in health or wealth

To change trusts included in your last will and testament

Your ability to change your last will and testament easily is usually a good thing. But our longer lifespans can cause some to be concerned they or their spouse may fall victim to a family member or caregiver who can use undue influence against you later in life.

If this is a concern, there are alternative planning tools available to your Maryland estate attorney. These tools may make changing your estate plan more difficult or prevent a change altogether without consent. If you can’t foresee changing your wishes on the beneficiaries or their shares, then you may not be too concerned.

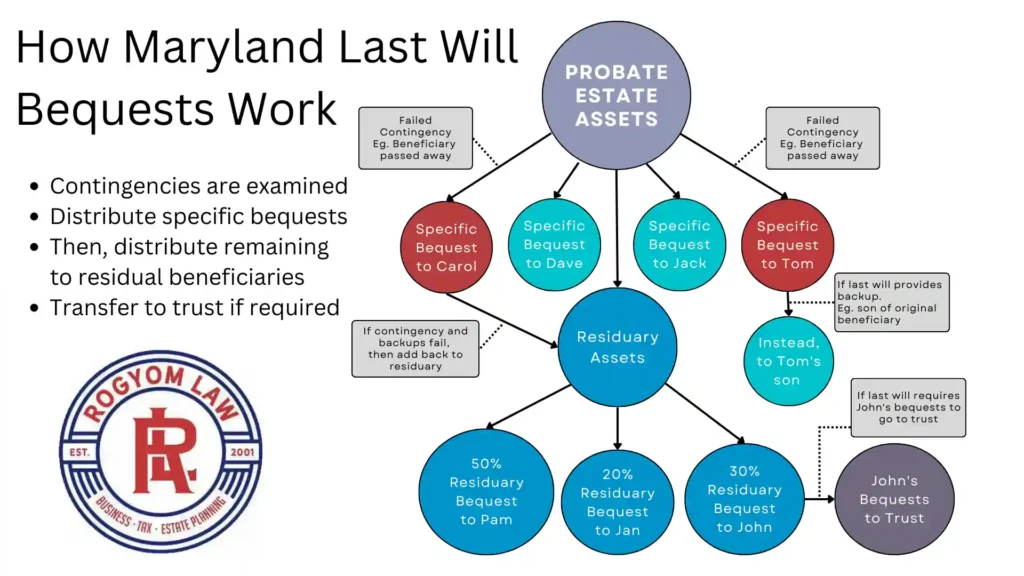

Types of Bequests in a Maryland Last Will and Testament

Clients often believe a last will and testament will need to address each asset of your estate. Maybe it’s because movies always show the family listening to a lawyer at the “reading of the will” say how one kid gets the motorcycles, another gets the stamp collection, and so on. Truth is, it’s rare for someone to mention any specific assets. Here’s how it really works.

Specific Bequests

Some clients choose to leave a particular keepsake or asset to their kids. So, you may mention that your Towson University ring and home in Monkton will belong to Karen, and your hunting land outside Smithsburg will be given to Joe.

Upon your passing, those assets will be given to those people. But if you sold your hunting land in Washington County and bought new land in Carroll County, then that specific bequest will fail unless you update your last will and testament to switch the locations.

Residuary Bequests

Most clients rely significantly or completely upon residuary bequests when dividing their estate in their wills.

When dividing the assets of your estate, those to whom you provide specific bequests will first be allocated those assets. After distributing that asset, whatever is left is called the residuary estate. The residual beneficiaries then receive their distributions of the residuary estate based on the percentage you allocate to them in the last will and testament.

Dividing Individual Assets for Distribution

The personal representative may either sell the remaining assets and distribute the proceeds or distribute the assets to the residuary beneficiaries. In any case, the personal representative will allocate the value to the beneficiaries based on the percentage you provided in the last will and testament.

So, even if you do not use a specific bequest to make sure Joe gets the hunting land, the personal representative may decide that the asset should belong to Joe, not Karen.

Given the likelihood you may need to update your last will and testament often if relying upon specific bequests, it is no surprise that most prefer to just allocate each family member a percentage and let the personal representative decide the proper distribution.

Contingent Bequests

We can make each of the above types of bequests conditional. We would consider those to be contingent bequests. A common contingent bequest would be any statement such as, “if my son fails to survive me, then my grandson shall receive X.”

On the other hand, you can make more custom-tailored contingencies such as, “if my son enters the military, then he shall receive my condo in Timonium, Maryland.”

Testamentary Trust Bequests

You can include a Maryland testamentary trust within the last will and testament so you can hold assets you bequest in trusts for later distribution. You may choose to do this for many reasons your Maryland estate attorney may suggest.

You may do this for tax purposes, protecting the recipient from receiving it all at one time, or to benefit multiple generations. Last wills and testaments commonly include one or more testamentary trusts.

A Wills Attorney Can Choose the Best Estate Planning Tool for You

Your Maryland estate lawyer would be the most qualified person to decide whether your estate planning should be based upon a last will and testament or a living trust. Each has its own positive points and negative points as well.

When would a lawyer use a last will?

Assets you transfer using a last will and testament will need to go through probate. Probate is the legal process for managing the estates of the deceased. Each Maryland county’s Register of Wills handles Maryland’s probate process. The Register of Wills will oversee the probate administration on behalf of the state. They will make sure the probate estate complies with important legal requirements. If the estate administration results in estate litigation, then the Orphan’s Court for that county will be where it’s settled.

In general, a last will and testament is the better choice for most young people. It is also the better choice for someone that would not want to pay the expenses of transferring the title of their assets to a living trust. Likewise, for someone that will likely sell and buy properties often in the future.

The last will and testament can include a testamentary trust for your spouse and children, without some burdens of a living trust.

There are also the personal burdens of having to make sure you continuously title assets to the living trust. If that is not done, those assets will end up being considered probate assets.

If you have very few assets that would need to pass through probate, then a last will and testament may be a better choice.

Further, if you are not concerned if your estate and last will and testament become public records, then you would not need the privacy provided by using a living trust.

When would lawyers use a Maryland living trust?

A Maryland living trust, also referred to as a Maryland revocable living trust, is a very different document from a last will and testament. The one thing they have in common is that both provide a plan to distribute your assets following your death. Assets titled in the living trust’s name do not need to pass through the probate process.

A Maryland estate attorney will generally consider the following factors to decide whether you should use living trusts:

- If you have a blended family and wish to have your spouse have access to your assets following your death but want the certainty that the remaining assets will go to your children, then your estate attorney may suggest using a living trust.

- If your assets are stable, not likely to be sold and replaced between now and your death, then your estate attorney may lean more toward a living trust.

- If you are of a more advanced age or believe you are in your later years, then your estate attorney may lean more toward a living trust.

- If you are concerned about your assets or other private matters becoming public knowledge, then your estate attorney would suggest using a living trust.

- If you are willing to spend more to have a living trust drafted and assets retitled to the name of the trust to later avoid the higher costs of probating your assets, then a living trust may be your better option.

- If you are concerned you or your spouse could later come under the influence of a family member or caregiver who will suggest or force you to change your estate plan, then your estate lawyer could suggest using a living trust. The unscrupulous individual will later find out your living trust owns your assets, regardless of what the last will and testament they forced you to sign states.

Note: We regularly turn away business from individuals who request a last will and testament for an elderly family member who suddenly want to give everything to them and disinherit their kids. While we do our part, this does not prevent them from downloading a Maryland last will and testament form online to do their harm.

Weighing the positives and negatives with a wills and trust attorney

After reviewing the above factors, you may be convinced you absolutely must have a living trust or a last will and testament. But your wills and trust attorney should have the experience and knowledge to look at your situation and let you know the type of plan you really need. The above factors are, of course, not exhaustive, and your estate attorney should be able to explain the reasoning behind their suggestion.

No matter why you have estate planning or probate concerns, we help guide you to a solution

Our practice includes advising clients with all aspects of estate planning, including the preparation of legal documents, as well as the proper use of those documents. When necessary, our estate lawyers will review and analyze estate planning documents prepared by other attorneys. We can assist you with:

- Establishing an estate plan.

- Executing Maryland Wills and Maryland Trusts.

- Creating Financial Power of Attorney and Medical Directive documents.

- Avoiding probate and getting a streamlined probate process.

- Preparing and using Maryland revocable living trusts and irrevocable trusts.

- Preparing and filing Maryland life estate deeds.

- Avoiding family disputes over your estate.

- Protecting clients from nursing home expenses through Medicaid and elder law planning.

- Protecting family members who may not be aware of your estate planning.

- Creating trusts to protect beneficiaries with drug or alcohol dependencies.

- Creating Maryland Special Needs Trusts for children with disabilities.

- Protecting your assets from creditors.

- Preventing probate problems.

- Filing tax returns.

- Obtaining exemptions from estate tax.

- Providing probate lawyer services.

Estate Planning and Maryland Law

State laws are very important with estate planning, and Maryland is no exception.

Maryland has estate and inheritance taxes that must be considered when drafting estate plans, and there is still a federal estate tax for the estates of wealthy individuals. These considerations often need to be balanced against Maryland income tax and federal step-up basis considerations.

Maryland requires the probate of estate assets, sometimes even for a single titled asset. For instance, a vehicle registered with the MVA could require you to open the estate of a Maryland resident to transfer title.

Maryland provides a spousal election, which allows a spouse who was provided a minimal inheritance from their spouse to elect to receive a more equitable amount.

Maryland does not recognize common-law spouses unless they became common law spouses in another state. Maryland also recognizes adopted and illegitimate children as having the same inheritance rights as children of marriages.

This is just a partial list of the complex issues that Maryland law can create when dealing with the estate of a Maryland resident.

We have the experience with both Maryland and federal law necessary to guide you in creating a solid estate plan that addresses our state’s unique concerns that affect everything from drafting your will and trusts to probate.

Frequently Asked Questions Clients Ask a Maryland Wills Lawyer

How long does a last will and testament last?

A Last Will never expires due to age. The person must take some actions to either cancel the document or replace it with a new Last Will and Testament. The testator must cancel the Last Will and Testament by some action intended to destroy or other overt act to cancel the document. If they create a new Last WIll, Maryland estate planning attorneys will include a phrase such as “any prior Last Will and Testament is hereby revoked” in the replacement document.

What is a Last Will and Testament?

A Last Will and Testament is a legal document containing instructions about what happens after you die. This document is most commonly used to provide for how to divide your property upon your death. But it can address a number of other issues as well, such as your burial requests and the naming your personal representative (your executor) and the guardian of your children.

How to find a Last Will and Testament?

If you cannot find a deceased relative’s will, you should search a few common placed where it may be. If they used an attorney, then you should contact that attorney’s office. Attorneys often keep at least a copy and sometimes the original of the documents.

If you do not know the particular attorney, you should any attorney friends of the deceased to see if they assisted or referred them to an attorney. The person’s accountant or financial advisor may know either the location or the attorney who prepared the Last Will and Testament. You may also want to request an attorney to send out an inquiry to the legal community to see if anyone helped prepare the document.

If they likely prepared the documents or cannot locate the attorney, then you will need to comb through the places they usually kept important documents. People may sometimes store documents in safety deposit boxes, but expect some issues with the bank when you try to access it. Though not common, the deceased may have filed the Maryland county’s register of wills and contacting them is worth a call.

Are Last Will and Testament public record?

Once the Last Will and Testament is filed with the Register of Wills to open the probate estate, in Maryland the document will be public record and accessible by anyone online. If the decedent filed the Last Will with the Register of Wills office for safekeeping, the document does not become public until the probate estate is opened. Many choose to use Maryland living trusts to keep their private business from becoming public.

How do I write a Last Will and Testament?

The Last Will and Testament must comply with the estate law requirements found in Md. Code, Estates and Trusts, Title 4, Subtitle 1. The person must be 18 and competent. It must be in writing, and signed by the person in the physical presence of two witnesses who must attest to and sign the Last Will and Testament as well.

Drafting your own Last Will and Testament can lead to many problems, even when using purchased or free legal forms. While some people get away with it, they may skip addressing many important things an attorney would never have missed. Even worse, the Last Will and Testament could be valid but causes so much confusion it ends up in litigation and creates huge attorney bills for your family.

Lawyers that do wills near me often get calls from families confused on what to do with a Last Will and Testament that was not properly prepared and signed. Sometimes, they can’t even find the Last Will. Using an experienced wills lawyer would likely have eliminated these issues.

Even if you can draft your own will, do you think it’s smart to do so? You are not just paying for a piece of paper with a wills attorney. The best estates and wills attorneys will listen to your wishes, but they don’t stop there. We will go through questions to determine what you truly need and respond to the information you provide with our concerns. Very often we inform you of issues you never realized existed. Could there be creditor situations or potential elder law issues that can cause your entire estate to be lost? Sometimes a free form comes at a big price, and when your family discovers the issue, it will usually be too late to fix it.

TESTIMONIALS