Protect Your Children Using Estate Planning

Make sure your children will be protected by your estate plan

Using Estate Planning to Protect Young Children by a Maryland Estate Attorney

We will do anything for our children. Parents have daily challenges of educating and caring for our children. We pray for them and pray we aren’t messing up. But we need to remember that our estate planning is crucial to protecting our children.

Estate planning will be the most important step you can take to ensure someone cares for your minor children if you are no longer here. A Maryland estates and trusts attorney can make sure someone will use your assets wisely for your children’s benefit.

We’ll discuss how estate planning safeguards kids and gives them the care and financial security they need.

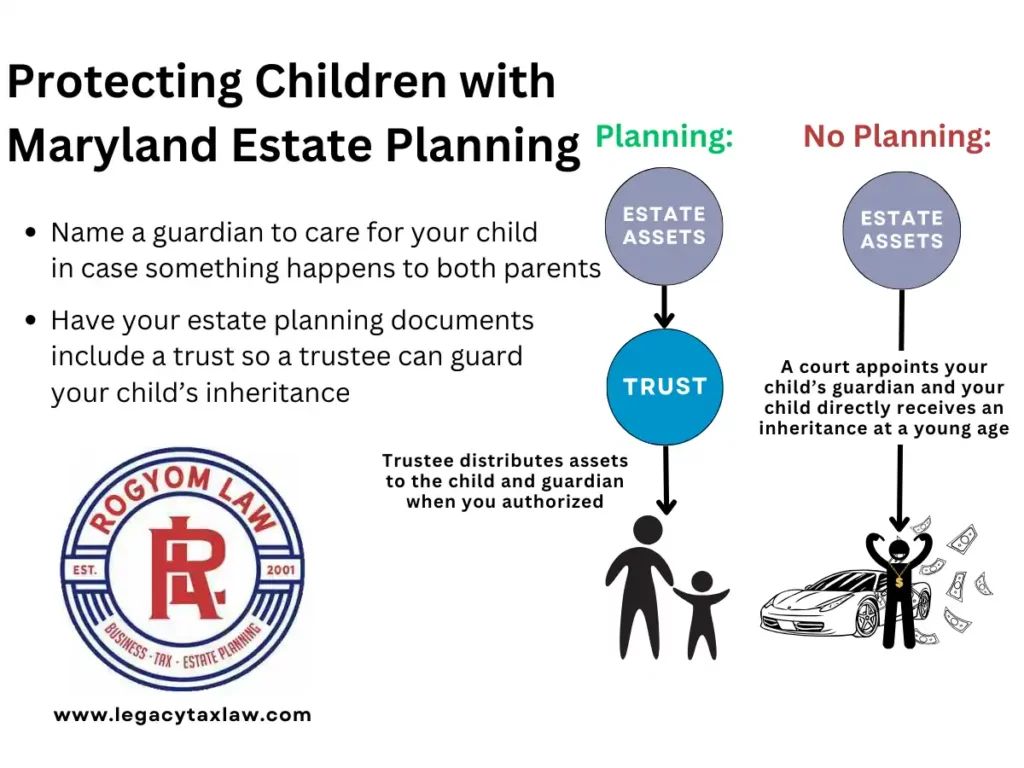

Protect your Children with Maryland Estate Planning

Your young family with minor children may just be starting your careers and may think your assets may not be enough to make estate planning necessary. You may be concerned about the cost or may think only older people need estate plans. But estate planning may be most important for families with minor children.

Using Maryland trusts to protect your children financially

You should include a trust in your estate plan for your minor children. Trusts can continue to hold assets after your death and delay distributing the assets. A last will and testament with no trust could require the inheritance to be distributed when the law requires, which could mean immediately.

Handing your entire estate over to your child when they lack life experience and maturity can lead to disastrous results. They need someone who can direct how your children can use those assets. You want your money to improve their lives, not just sustain them. The trustee you appoint will watch over the minor’s trust and its assets.

The trust agreement you create will guide the trustee. It directs how the trustee should invest and use those assets for its beneficiaries. The trust agreement needs to let the trustee distribute funds for the child’s health, education, maintenance, and support (HEMS).

You can be specific on these HEMS provisions, such as what education you intend to fund, or you can leave it at the trustee’s discretion. You can also specify that you would like the trustee to release funds early for perhaps a wedding or down payment on a first home.

Your trust may still have assets after making distributions for the child’s support. This may depend upon the size of your estate and the trustee spends and invests the trust’s funds.

There may be an age at which you feel it’s appropriate to release the assets from the trust and distribute them to the child. We usually suggest you distribute the assets over time, rather than in one big distribution.

Most of our estate planning clients prefer having three distributions. The beneficiary’s age at which our clients choose to distribute the funds will vary, but most choose the ages 25, 30, and 35 for when trust makes the three distributions. We can, of course, alter this into more or fewer distributions and use different ages of your choosing.

Keeping assets in the trust longer protects them from creditors and negative life events that could affect their inheritance. We’ll discuss below the special circumstances requiring additional restrictions needed to protect the child.

Ready to get started? We’re Ready to Help.

Contact us now and we’ll be happy to schedule a call or meeting with no commitment.

If we cannot assist you, we will gladly provide you with referrals.

Types of trusts used for children’s trusts

The type of trust used for protecting your minor children could be a testamentary trust or a living trust. Your last will and testament specifies the terms of the trust agreement and selects the trustee. The testamentary trust will not come into existence until after you pass away.

The more complex trust would be a living trust. You and your spouse form the living trust and can transfer funds to it during your life. You would be considered the trust’s settlors and could be the trustees of the trust while alive. The living trust can help your family avoid probate, but there are certain cost and benefit of living trusts to consider.

Investing for minor children in estate planning

You may already do some things necessary to provide for your children if something were to happen to you. The investments you make become assets used for your estate planning. Some investment types:

General Savings – Your home and retirement accounts likely make up much of your assets. These can become assets to fund trusts that will safeguard your children’s financial future as well. You may need to make your children’s trust the beneficiary of any 401k, 403b, and IRA accounts, rather than the children.

College Savings – You may already be saving money for college for your children through the Maryland 529 plan or similar. The child or their guardian can use these accounts for your child’s education and will relieve some of what your general savings will need to fund.

Life Insurance – Couples usually intend a life insurance policy to benefit your surviving spouse. Life insurance can, instead, be used to fund the trusts that couples form as part of an estate plan. Name the living trust or testamentary trust you created as the beneficiary for the insurance policy instead of naming the child. The trust will then distribute the insurance proceeds to the child according to your trust’s terms.

Appointing guardians for your children

Your naming your child’s guardian may be the most important part of young families’ estate plans. The guardian will be the person primarily responsible for caring for your child if there is no surviving spouse. You will hopefully be able to find someone that has similar values and thoughts on how to raise children.

Picking your children’s guardian

In an ideal world, we’d all have a friend or family that we’d love to be your child’s guardian. This understandably will be one of the toughest decisions you ever make. Parents often get frozen on completing their estate planning over this one choice. But, remember, done is better than perfect and you can always change the person you name.

You should not delay completing your estate plan because of a prolonged search for the perfect guardian. Besides, if they were perfect, maybe we should give our kids to them now, right?

What are the guardian’s powers?

The State of Maryland gives guardians decision-making rights similar to those of a parent. Think about all of those consents we regularly sign for our young children with doctors, schools, and similar. That should give you a better understanding of their rights and responsibilities. They serve as guardian until your child becomes of age.

How do you name the guardian in your estate plan?

A Maryland parent’s estate plan should name the guardian in their last will and testament. In Maryland, if you have a living trust-based estate plan, your attorney will ask you to sign a “pour-over will” to ensure all assets go to the trust. Naming your child’s guardian will be one more reason for having that pour-over will in place.

What happens if you don’t appoint a guardian for your children?

If you don’t choose a guardian for your children, your family and friends may not know who should take care of them.

The person you would have wanted as guardian may not apply. Maybe the person isn’t assertive, doesn’t know your family situation well, or just doesn’t believe themselves worthy. Some overly assertive person, who you would never name as guardian, could file with the court to have themselves appointed as guardian.

The judge deciding who will be guardian will not know either your children or the potential guardians as well as you. The parents’ input will be critical to ensuring your children go to a decent home.

Should the guardian be the trustee as well?

You will hopefully be able to find someone that can be both guardian and trustee. Even if they are capable, you could prefer having another person handle the assets, rather than the guardian. It does, however, make sense usually that the guardian would have your child’s best interests financially as well.

They may not want others to decide when they and your children should receive financial support. You could consider having additional oversight on how the guardian uses the money. Your Maryland estate planning attorney can guide you using their experience in similar situations when they create an estate plan.

Special considerations in estate planning for minors

You should determine whether your family has any situations requiring additional attention while trying to establish an estate plan.

Special needs – if your child has special needs, then any trust for the benefit of that child should preserve the child’s government benefits. Your attorney should draft the trust as a special needs trust so the government does not consider the child as the owner of the trust’s assets. This could cause them to exceed the asset limitations for Medicaid and other programs.

Other concerns – while maybe not disabled, you may believe your child may need prolonged help with their finances and care no matter their age. In such cases, you may have the trust delay distributions. This may allow the trustee to take a greater role in the child’s welfare.

The trustee can guard and distribute the trust’s funds on the child’s behalf. The trustee may consider the child’s mental well-being, learning disabilities, and emotional distress.

Single parents – Single parents may have special concerns if an absent parent may not be a good person to serve as guardian of your child. Courts rightfully give a living parent the favor of the doubt on whether they should be primary caregivers of children. Such absentee parents can assert those rights.

This will not prevent you from at least asserting that they should or should not be guardian or naming another that has a had a greater role in the child’s life. You can also remove that absentee parent’s financial motivations by putting your estate’s assets into a trust. The trustee would control the use of the child’s funds.

Understanding estate planning basics

You make an estate plan by creating the legal documents that will govern what happens upon your death, including the distribution of your assets. Your attorney should advise you on what estate planning documents you will need and how to structure your children’s estate plan.

Attorneys use last wills and trusts as the key documents in estate plans.

- Last will and testament – Specifies what happens to your things after you die. It names your personal representative (your executor) who will carry out your last wishes.

- Trust – A legal entity allowing you to control the distribution of your property. Unlike a last will and testament, the trust holds the assets, can distribute the assets over time to its beneficiaries, and can exist both while you are alive and after your death.

Other legal documents your Maryland estate attorney will probably create for you include:

- Financial Power of Attorney – Allows you to appoint someone to handle your finances and legal tasks if you become incapable of doing so yourself.

- Medical Power of Attorney and Living Will – Allows you to appoint someone to make medical decisions on your behalf if you cannot do so.

A parent will want to create a solid estate plan that will protect your children, particularly your minor children. Proper estate planning ensures your assets go to your children and that you choose the person who will be their guardian, rather than a court.

Helping protect your children with estate planning

We would be happy to help guide you in creating an estate plan appropriate for your family. We can help draft all the documents needed and guide you on deciding how to ensure your children have the best future possible.

As parents, we understand your concerns and hopes for your children. We are passionate about providing estate planning for people with minor children. The benefit for your children can be crucial to their well-being.

TESTIMONIALS