Revocable Living Trusts

Trusts that help avoid probate and provide other benefits

Maryland Revocable Living Trust Lawyer

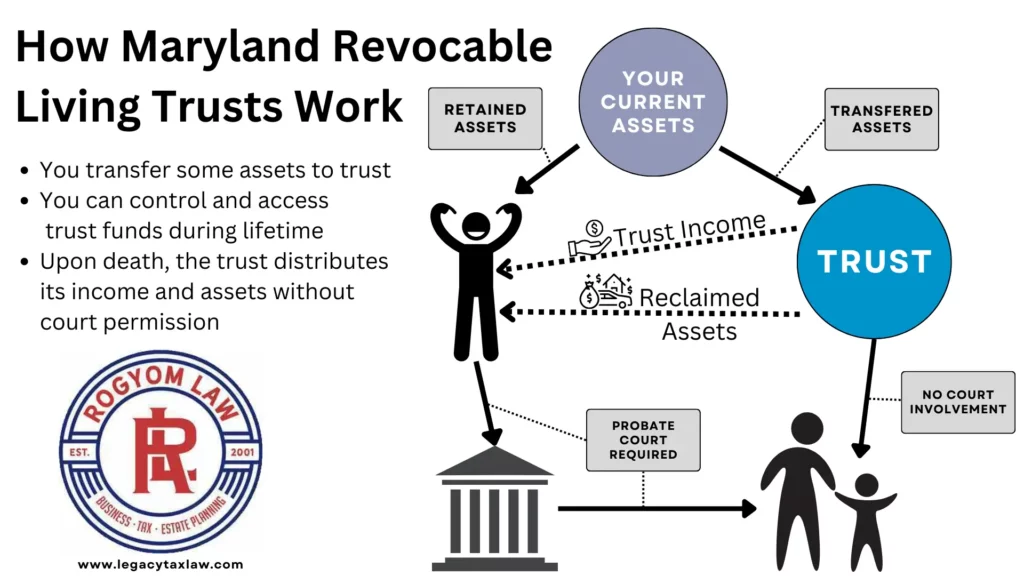

One of the most powerful tools of a Maryland trusts and estate attorney for estate planning is a revocable living trust. People often refer to such trusts as a Maryland living trust or as a Maryland revocable trust.

You can transfer your assets to a living trust during your lifetime. Then, the trust can use those assets to provide for you during your life. After your death, the living trust can streamline the transfer of your property to your family without the trouble caused by the Maryland probate court process.

What is a Maryland Revocable Living Trust

A Maryland living trust creates a legal entity and allows you to transfer your property to it while still living. Since it remains revocable, you can maintain control of your property and its income while still living.

You maintain control of its assets because you can alter or revoke the living trust as its grantor in its entirety while alive and have capacity. You determine how and when it distributes its income and assets during your lifetime and after your death.

What are some advantages of creating a Maryland living trust?

- Your family can avoid probate

- Your estate’s assets and your distribution plans can remain private

- Your family receives a step up in basis on appreciated assets

- You remain able to control and receive trust funds while living

- You decide when your beneficiaries receive distributions

- If you own real estate outside Maryland, you can avoid a costly ancillary probate of those out-of-state properties

- If you become incapacitated through illness, it may avoid a guardianship

- Someone attempting to change your estate plan may have difficulty doing so

Who controls a revocable living trust?

Like all trusts, the trustee controls its assets. You choose the trustees both for when you are alive and for after you death. Most appoint themselves as the original trustee so they maintain full control of the trust property during their lifetime. You must also name a successor trustee who will act as a trustee in your place when you die or if you become unable to while you are living.

How do revocable living trusts avoid probate?

For your family to be required to open your estate through probate with the Maryland Register of Wills there needs to be assets in your estate. Your family won’t need to open your estate if you transferred all of your property to a living trust before your death. The register of wills considers a living trust and its trust assets to be non-probate assets, making probate unnecessary.

Ready to get started? We’re Ready to Help.

Contact us now and we’ll be happy to schedule a call or meeting with no commitment.

If we cannot assist you, we will gladly provide you with referrals.

Do I need a revocable living trust as part of my estate plan?

Not necessarily. Whether you need or should get a Maryland revocable living trust depends upon your circumstances. Most choose a revocable living trust because of its ability to avoid probate and the delays probate causes.

Some value the privacy of using a revocable living trust. Unlike a last will and testament, you do not need to open probate and file a living trust with the Register of Wills. You do not need to disclose the assets you owned at death or show the world the terms of your estate planning.

Business owners often use revocable living trusts. It allows a smoother business transition following your death to the next generation or chosen management team. Including a business in your probate estate can lead to complications. Both the probate process and the control allowed the personal representative may not be something you’d intend.

An experienced Maryland estate attorney may suggest other techniques to accomplish your goals. So, while revocable living trusts can be great planning tools, you should still have your Maryland estate attorney help guide you in your decision.

Can I keep control of my assets in the living trust?

A wonderful benefit from your forming a Maryland revocable living trust is that you can keep control of your assets. You can form a living trust so you can continue to use and access the assets you contribute to provide for your personal and financial needs while alive. This may include paying for medical and living expenses, as well as providing for the individual’s children or other dependents.

As the trustee, you can take an asset out of the living trust or sell it altogether if you wise to pay for your financial needs or the needs of your family. You can also change its term or terminate a living trust completely.

How do I form a Maryland revocable living trust?

While a Maryland estate attorney should guide you on forming a revocable living trust, you should still become familiar with the steps to form a trust.

You can gather some information to prepare, but do not get bogged down in the details before contacting a lawyer. Your lawyer can review your information and then provide helpful guidance and assistance with planning.

1. Determine what property should become trust assets.

Make a list of all your assets, including real estate, bank accounts, investments, and personal property. You also would want to list information about any life insurance policies or other death benefits. You can transfer property to a living trust during your lifetime. But you can name it as a beneficiary of non-probate assets, such as life insurance policies. Your estate can also transfer assets to the trust using a pour over will, discussed below.

2. Choose the beneficiaries of your trust.

You can then decide who receives your assets after your death. The living trust’s beneficiaries can be family members, friends, or even organizations. The trust beneficiaries can also follow in sequence. For example, you can leave the income from your assets to your spouse or minor children and then have the assets go to another person.

3. Determine who should be trustee.

You should keep in mind who you want to be trustee. Most choose a family member or friend to be its trustee. In other cases, some choose their lawyer. a financial advisor, or similar individual.

You obviously want someone you can rely upon to care for its assets. From my experience, you want someone who also takes an interest in the beneficiaries’ well-being. You choose both the initial trustee and successor trustees.

4. Create the trust document.

Work with your attorney to draft a trust agreement. Your trust agreement should outline the trust’s terms, your asset distribution plan, and the trustee’s duties. This is likely the most complicated part of forming a living trust, but an attorney should be able to make suggestions to accomplish your goals. Your part in this process should be to come up with the goal of a living trust.

5. Sign the trust agreement.

Your attorney usually prepares all of your estate planning documents, including your trust, at the same time. This likely includes powers of attorney, medical documents, and a pour over. A pour over will is a last will and testament that typically accompanies a revocable living trust. Upon completion, the attorney usually has you sign your documents with a notary present.

6. Fund the Md. living trust.

After you have signed the trust agreement to form a living trust, you may have your attorney draft the documents needed to transfer assets to it. People often refer to this as funding a trust.

Sometimes third-parties, such as banks and investment companies, provide the documents. Other times, you need legal documents prepared. For instance, your attorney may prepare real property deeds or documents transferring your corporate or LLC interests to it.

7. Establish tax status if needed.

Sometimes, the living trust needs to get a tax ID number or EIN from the IRS. Whether you need one depends its written, the assets it holds, and similar.

Other times, it may need to qualify with the IRS to hold other interests, such s corporation stock. Your attorney and tax advisor likely need to instruct you regarding the trust’s tax compliance.

8. Store the trust documents.

Storing the documents properly is very important for your family. You must not only keep the trust agreement and asset transfer documents and information as well. This may be less of an issue if it includes only titled assets, such as bank accounts and real property. Third parties keep track of those transfer documents to determine ownership.

Properly storing the documents becomes far more important when we try to determine whether the trust owns assets, such as an LLC. If your trustee or family cannot find the LLC’s membership assignment documents, then they have no proof you ever transferred it.

What is a pour over will for a living trust?

Your attorney usually includes a pour over will to accompany your revocable living trust. This type of last will and testament names the trust as the beneficiary of assets you may not have put into your trust. The pour over will may also address some matters that you legally need to include in a last will and testament, rather than in a trust.

Putting all of your known assets into a revocable living trust may not always avoid probate. There can still be situations where an asset doesn’t make it into your trust and makes probate necessary.

You may miss transferring an asset to the trust for many reasons. Sometimes grantors omit assets because of simple error. Sometimes the grantor dooen’t even know the asset existed, such as a surprise inheritance. Other times, maybe the asset itself didn’t exist while you were alive.

For example, if a vehicle accident causes someone’s death, then the individual may have a legal claim that was not created until your death. A pour over will transfers probate assets to your trust to be distributed as you choose.

Finally, the pour over can also address things Maryland law states you must include in a last will and testament, such as guardianship of any minor children.

Can a revocable living trust help avoid a guardianship?

If an individual becomes incapacitated, then the successor trustee can step in to help. While you typically keep control of its assets during your lifetime, you can include in the trust agreement that you want to be removed as trustee if you become incapable of caring for yourself.

Families prefer to avoid guardianships, which is a costly, time-consuming, and painful process. A revocable living trust can allow the successor trustee to care for them, protect the assets, and can prevent the need for a guardianship.

Rules a trust attorney follows for a valid trust in Maryland

Though Maryland allows a huge amount of discretion in the trust’s terms, it must follow Maryland law requirements. Some of those rules include that the settlor must have the mental capacity to form the trust and have intended to do so. Also, the trust must have a beneficiary that is ascertainable unless it’s a charitable trust or a trust for pets.

Your trust can name specific person, a class of people (such as your grandchildren), or allow the trustee to decide its beneficiaries. Maryland law considers each of those an ascertainable beneficiary.

Other Maryland rules, particularly those in the Md Trust Act, govern how trusts must function and the rights and obligations of settlors, trustees, and beneficiaries.

Common Questions about Maryland Revocable Living Trusts:

How does a revocable living trust provide privacy to my family?

A revocable living trust provides privacy to your family because its a private document. Only those allowed either by the trust agreement or by law can access the trust’s details.

More important, your family does not have to send the trust agreement to the Register of Wills to open an estate. Therefore, the document does not become a public record like a last will and testament at the time of your death.

During the probate process, your family needs to file the last will and testament and information regarding your assets. The public could discover the persons you named or didn’t name in your last will and testament. They can also see sensitive information both about your assets and your family. A living trust completely avoids this issue.

What are the disadvantages of a revocable living trust?

There are many advantages to having a revocable living trust, such as flexibility and the ability to change it if desire, but there are some drawbacks to consider. First, there are no income or estate tax benefits compared to just continuing to own the assets in your name. As the grantor, the IRS treats you as having kept ownership of the property and you’ll pay taxes as usual. The good news is that estate taxes are rarely an issue for families nowadays and your family receives the huge benefit of a stepped up basis on trust assets for income tax purposes. Since you keep your access to the assets, it does not provide the same level of protection against potential creditors as an irrevocable trust. Finally, setting up and maintaining a revocable living trust can be expensive and time-consuming.

Some disadvantages definitely exist. The best estates and trusts lawyers share that information and alternatives, even if cheaper.

Who owns the property in a revocable living trust?

If you contribute property to a revocable living trust, it is the owner of the property for legal purposes. This does not mean that you cannot lose control of the property. As a revocable living trust, you can name yourself as the initial trustee and keep rights as the settlor to withdraw property from it.

A Maryland estate planning attorney often drafts the trust agreement so the IRS continues to treat you as the assets’ owner. Doing so avoids the higher tax rates that apply to income earned by a living trust.

How is a living trust different from a will?

There are substantial differences between living trusts and a will. Usually you transfer your assets to a living trust during your lifetime, while a will transfers assets you still held at death.

Unlike a will, a living trust does not require probate, which is the process of obtaining court approval for a person’s estate to be distributed to heirs. The transfer of assets to the heirs is usually quicker and less expensive when using a living trust compared to a will. Additionally, living trusts offer more privacy and flexibility than a will as they are not public documents.

Will I lose any control over my property if I create a Revocable Living Trust?

No, you do not lose control over your property if you create a revocable living trust. It allows you to maintain full control over your assets while you are alive with all ownership rights. You can make the trust sell or refinance a home. If you become incapacitated, the Trustee can manage the assets for you.

So, let’s say you own a home in Glen Arm and a cabin outside Smithsburg. If you later decide you want to sell your Glen Arm home and use the funds to retire in Smithsburg, then you may do so. That is one benefit of a revocable living trust.

Is a revocable living trust or power of attorney better for avoiding a guardianship?

A Maryland power of attorney allows another to manage your finances and your assets. However, a power of attorney cannot stop others from taking advantage of you as well as a living trust. For instance, a power of attorney does not prevent you from continuing to send money to a dishonest caregiver.

You can stop con artists in their greedy tracks by placing your assets into your living trust and having your trustee rights revoked if diagnosed with Alzheimer’s, dementia, or similar illnesses.

Do I have to transfer all my assets to my living trust?

You are not required to transfer all your assets to your living trust. You may decide that you should keep some property in your own name. This usually depends upon the types of asset you own. It can also depend upon whether you intend to sell the asset soon or if it allows beneficiary designations. Under some circumstances it may not be in your best interest or worth the expense to place it into the living trust.

However, in some circumstance you may want to do so. If your life expectancy is not very long, if you expect to own the asset until death, or if you otherwise have no estate plan in place for that asset, then it may be best to transfer it.

You should rely upon the advice of a good Maryland Trust Attorney, Md. Code, Estates & Trusts §14.5–101, to assist you because of such complexity. Getting the trust agreement is just the first step in trust-based estate planning.

TESTIMONIALS