Buying or Selling a Business in Maryland

An Experienced Maryland Business Attorney

guiding clients through business sales

Buying or Selling a Business in Maryland

Buying a business can be very tricky. Not only do you need to find a great deal on the right company, but you also need to avoid the many pitfalls that could affect the purchase and success of one of the biggest purchases of your life. If you are buying or selling a business, you need an experienced Maryland business lawyer who will guide you through the process and help you avoid costly mistakes.

Whether you are buying or selling a business in Maryland, there are many important things for you to consider. It is important to know the basics of buying and selling a business in Maryland. We will cover what you need to know about the process of buying and selling a business.

Getting Started with a Business Purchase and Sale

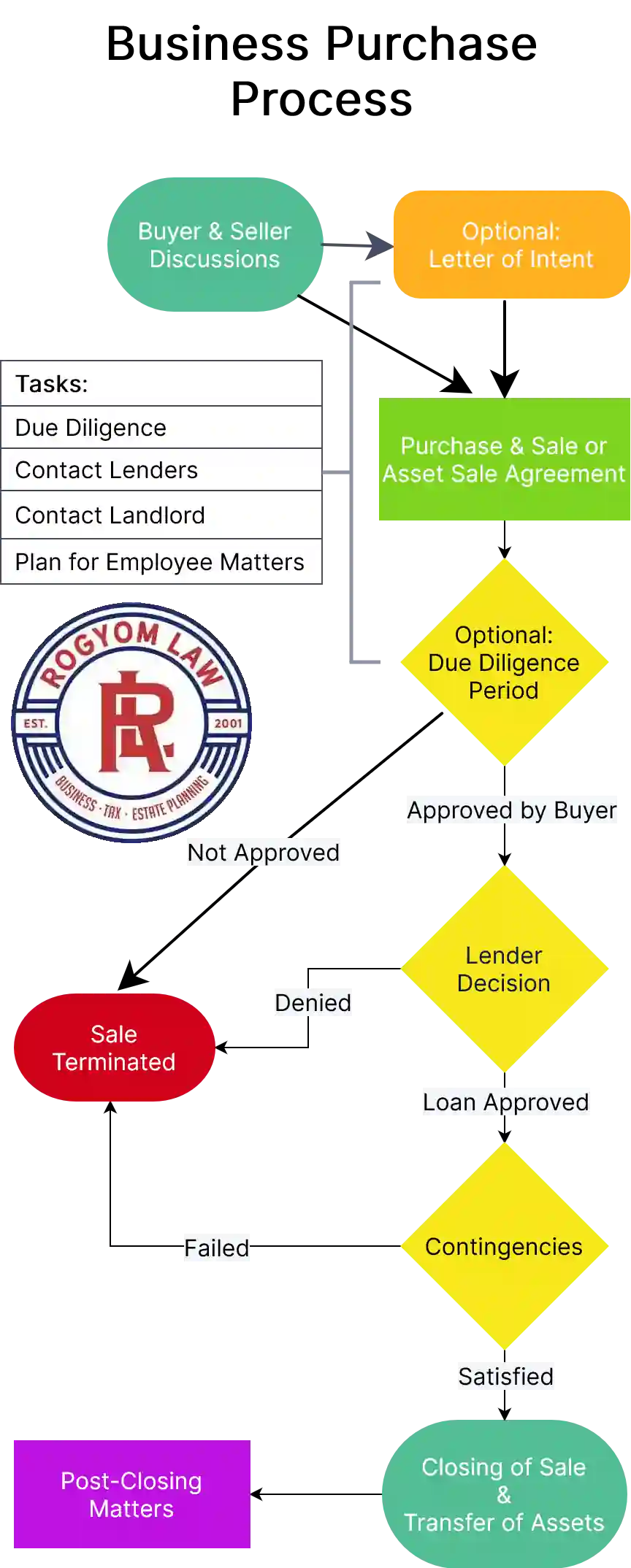

While it’s easy to get excited about purchasing or selling a business in Maryland, the work done in the beginning by the buyer and seller will often be the most crucial in deciding whether the sale will be a success. It’s important that there be a meeting of the minds between the buyer and seller of the business. That is, the buyer and seller should agree upon the general terms of what the business purchase agreement will be.

The buyer and seller of the business will often, but not always, decide they want in writing the basic terms of the proposed deal. This document, known as a letter of intent, or LOI, between the business buyer and seller is often the initial step in the purchase process.

A Letter of Intent states that both parties intend to soon enter into a binding contract and provides a general roadmap for the terms. A Letter of intent should include the parties’ understanding on the following terms:

- a description of the assets being transferred

- the price to be paid

- the payment method

- the time when the sale will take place

- whether a deposit will be paid

- expectations for current owners after the sale

- the structure of the sale, whether it will be an asset sale or sale of the business entity

- whether the Letter of Intent will be binding or nonbinding

If the Letter of Intent is not binding, then the parties will not be obligated to complete a formal sales agreement and both can walk away from the deal.

Your Maryland Business Sale Attorney should be included in drafting the Letter of Intent, since the parties will likely expect its terms to be honored even if not binding.

For further information, some of the basics of the buying and selling a Maryland business are outlined in my article Buying or Selling a Maryland Business – The Basics.

Due Diligence in the Purchase and Sale of a Business

Before you buy any company, you will want to make sure you have completed an adequate amount of research. Researching the company that you are planning to buy is a crucial step that needs to be taken. It is important that you learn everything that you can about the company, its financial status, its products, its employees, and its customers. You should not buy a business without having a thorough understanding of it.

The first thing you should look into is the finances of the business. Make sure that the business has sufficient funds to pay for its expenses and whether it has accumulated any debts. You may want to have your accountant verify that the financial reporting and tax returns of the company accurately reflect the status of the business.

The due diligence process should include any material facts about the seller and the assets of the company that you believe could affect the success of the business. While due diligence can take place before the purchase and sale agreement is even drafted or during a “due diligence period” after its signed, the due diligence process should be complete before the closing date so you don’t have to worry about any problems that may arise after the sale.

If there are liability concerns, whether from creditors or potential claims of people who may sue the company for past activity, then those problems should be addressed very early in the process, preferably before even a Letter of Intent is drafted, since it’s possible to structure the sale to limit that risk.

For more information on dealing with the liabilities of a business you want to buy, please see my article Buying or Selling a Maryland Business – Past & Future Liabilities.

Taxes from Buying and Selling a Business

If you buy and sell a business, you should make sure you consult with an accountant or a tax lawyer about your tax concerns from the purchase or sale of the business. Ignoring the tax issues that occur with any business purchase can lead to costly mistakes.

It is better to have an attorney help you sift through the details of business purchase, preferably a Maryland business attorney that has experience in dealing with this type of transaction and who will be able to at least recognize the tax consequences of the purchase and sale of a Maryland business and that keeps informed on federal and Maryland tax laws that change are constantly changing.

While there are exceptions, the IRS generally taxes the gain on the sale of your business at capital gains rates, instead of ordinary income rates. Capital gains are usually lower than ordinary income taxes, so you can reduce the amount of taxes you pay. However, you will need to pay taxes on it in a certain time period and you could pay higher tax rates depending upon that timing.

These considerations can often affect the way the parties agree the purchase and sale of the business will occur, whether the parties want to buy and sell the business all at once or over time through an installment sale, and whether it’s in the best interest of the seller to just hold on to the business until they can take advantage of a step up in basis that occurs at death.

A buyer of the business will have a couple generally be concerned that they will receive the benefit of the amount they paid for the business will be included in the tax basis of the company and its assets. But there are also transfer taxes the buyer may be responsible for, including the Maryland Bulk Sales Tax and taxes for any titled assets, such as vehicles and real estate.

Before you sell your business, it’s important to understand IRS rules so you can both comply with requirements and know the tax consequences of the sale. For more information on the taxes from a business sale, here is a link to my article on the topic Taxes from Buying or Selling a Maryland Business.

Financing the Purchase of a Maryland Business

There are many financing options available if you want to buy a business. The simplest option is seller financing if the seller is willing and able to do so. A benefit to the seller is that the taxes may be spread out over a longer period and at lower rates, but there are obvious risks.

The buyer could also seek investors willing to take an equity interest in the company, but there’s the downside of needing to satisfy your new co-owners that may want a say in the business’s operation. If those financing options are not available or wanted, then the most common way of purchasing a business is through a loan from a lender.

Loans for business purchases fall into two broad categories: conventional loans and SBA loans. Conventional loans have higher interest rates than SBA loans and they typically are not willing to lend as much since there is no SBA guarantee insuring the risks. The U.S. Small Business Administration guarantees SBA loans for buying a business, making lenders more willing to lend when you would otherwise not be able to obtain a conventional loan. But an SBA loan comes with administrative headaches, a longer processing time after the loan application is filed, and the SBA has strict criteria that must be met by the business and the buyer to be able to qualify.

It’s possible for someone to qualify for a conventional loan but not an SBA loan and vice versa, so you should work with a lender that’s able to lend under either program. You will also want to make sure your lender has extensive experience with business purchases and sales since a business purchase loan can be far more complex and have more twists and turns than a routine real estate loan.

Financing can be complex and it’s important to find both a Maryland business attorney and lender you trust to help guide you through the process. If you have additional questions regarding this topic, please review my article, Financing the Purchase of a Maryland Business.

Transferring the Assets of a Purchased Business

While the purchase and sale of a business can take the form of either a sale of the entity or the sale of the assets, you will still want to confirm that all assets of the business have been transferred. Sometimes this will include making sure that the seller business entity actually owned the property and that it was not titled to, for instance, the owners of the business instead. If the business entity owns the assets and the buyer purchases the business entity itself, then assets will transfer with the entity.

However, if the purchase of the business is structured as an asset sale, then the documentation must show that the assets have been transferred, whether individually or by category, for example, “all inventory of the business.” The Maryland asset purchase agreement should give a description of the assets to be included in the business sale and purchase. At the closing of the sale, those assets must again be listed on documents to complete the transfer.

The closing documents will generally include, at minimum, 1) the Settlement Sheet, which provides the payment information, 2) a Bill of Sale, which transfers the physical assets, and 3) an assignment of intellectual property and other, nonphysical assets, such as trademarks, patents, copyrights, domain names, websites, software programs, the company name, phone numbers and similar. Additionally, there may be a need to have specific documents for the transfer of other assets, such as those meeting the requirements of the Maryland Motor Vehicle Administration or deeds for real property.

If you are transferring assets of a purchased business or assigning them to a new owner, you must complete the required documentation to transfer ownership and title. It is important to ensure that all assets are accounted for and properly documented. For additional information please review my article on the topic, Transferring Assets in a Maryland Business Purchase and Sale.

Transferring Leased Property in a Business Sale

There are several issues you need to take into consideration with the transfer of a lease as part of buying and selling a business. First, there’s the question of the lease itself and the property being leased. Is the property up to par with what you need for the business, or would you want to move the business to a different location?

If not, what are the terms of the lease, including the amount being paid, the current and future responsibilities of the tenant, and the remaining duration of the lease? Of course, business equipment may also be leased, and must be similarly addressed.

Since the buyer refusing to take over the lease would likely be a deal breaker for the seller, we need to consider whether the lease allows the transfer of the lease to whoever is the owner of the business. Typically, the lease agreement will say that the tenant must get the approval of the landlord to transfer the lease or the business occupying the space.

Therefore, very early in the process, the seller should approach the landlord to make sure they are open to the transfer and the landlord’s requirements to approve it, who may require similar credit, asset, and background checks they used when approving the lease initially. Buyers that are interested in continuing the lease, at least initially, will often make the landlord’s consent to the transfer a contingency of the sale, so the sale agreement will automatically terminate if not approved.

If approved, the landlord and parties will agree to one of the following: a new lease of the property, an assignment of the lease, or a sublease. In any case, the agreement may require the seller to continue to be liable for the remaining term of the lease if the buyer defaults. For additional information on this topic, please see my article Transferring Leases with a Maryland Business Sale.

Employment Agreements in Business Sales

When buying a business, the purchaser will have concerns about the people associated with the company. It’s common for the buyer to require the seller to sign a noncompete agreement, a confidentiality agreement, and a non-solicitation agreement.

There may also be certain key employees that should be given employment agreements to ensure they continue with the business after the sale and do not leave with the business’s customers, suppliers, or contacts. For all employees, the buyer will want to know the compensation package they receive and the buyer’s obligations to those employees going forward.

It is sometimes the case where the buyer will also want the owners to continue with the business or at least continue long enough to ensure a smooth transition after the sale. The general terms of such agreements are often included in the purchase agreement.

Since the buyer may be obtaining confidential information about the seller’s business during the course of the sale transaction, the seller may require the buyer to execute a confidentiality agreement. For more information about this topic, please see my article Employment Agreements in Sales of a Maryland Business.

Conclusion

In conclusion, when you’re buying or selling a business, you need to take the time to make sure you are properly informed on all relevant issues. The above are some of the general considerations that need to be taken into account.

The purchase and sale of business in Maryland can be complex and there are many opportunities along the way where things can go sideways. It’s important that you have a Maryland business attorney that has substantial experience with the sale of a business since that experience helps you navigate those problems that can arise in a business acquisition.

If you have any questions about the purchase or sale of a business, don’t hesitate to give us a call. We’ll be happy to help!

“When we purchased our business we had Jeff help us. The guy selling it knew he was going to have tax issues from the sale, and he almost backed out. Jeff came up with a plan that worked out well for all of us. The deal went through and everyone walked away happy. We’d definitely recommend him.”

TESTIMONIALS