Life Estate Deeds

A simple way of accomplishing great things

Can a Maryland Life Estate Deed Benefit You?

As part of your estate planning, your Maryland Estate Planning Attorney may suggest you title some of your assets as a life estate. You may wonder what exactly is a life estate, and how do they work? On this page, we’ll explain the basics of a life estate deed in Maryland. We’ll also explain how they are formed, what the advantages and disadvantages are of using one, and when it is appropriate to use them as part of your estate plan.

What the Heck is a Life Estate?

A life estate deed is used to transfer ownership of property from one person to another. The term “life estate” means that the person owns the property until they die, at which time it will pass to the other person. You create a life estate by titling the property. Upon your death, the property automatically transfers with no further action needed by your survivors.

How Does A Life Estate Work?

Many clients are familiar with Payable on Death accounts some banks offer. You have access to the funds during your life, and upon your death, the account or its funds will transfer to the person you name as beneficiary. A life estate deed functions somewhat similarly.

Typically, if someone refers to a life estate, they are speaking about real estate. Life estates generally refer to real estate, therefore, that will be the focus of this page.

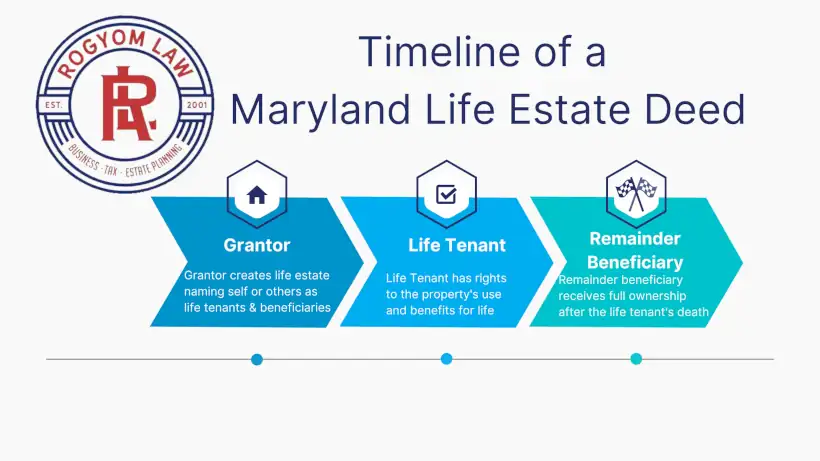

Who Is Named on a Life Estate Deed?

All life estate deeds will include a few people:

Life Tenant

The life tenant is a person named in the deed who will right to use the property. The life tenant may receive the right to live in the residence or otherwise use and receive the benefits of the property for the remainder of their life. With most life estate deeds, the person who grants the life estate grants the life tenancy to themself. This is particularly the case when it’s being used as a tool for estate planning. However, it is possible that another person formed the life estate, making the life tenant the person entitled to the property for the remainder of his or her life.

Remainder Beneficiary

The remainder beneficiary will become the owner of the property after the death of the life tenant. The remainder beneficiary, also known as the remainderman, does not have the right to use the property while the life tenant is alive. Additionally, the remainderman cannot legally sell, mortgage, or rent the property during the term of the life estate.

Grantor

The grantor is the person who creates the life estate. While the grantor and the life tenant are usually the same person, this is not always the case. Sometimes, the grantor can be a third party who creates the life estate to benefit another person who is the life tenant and another person who will receive the property upon the death of the life tenant.

The life estate can include more than one life tenant and can have multiple remainder beneficiaries. If more than one life tenant, the life estate ends upon the death of the last living life tenant. If there are more than one remainder beneficiary, then each becomes an owner of the property upon the termination of the life estate.

Ready to get started? We’re Ready to Help.

Contact us now and we’ll be happy to schedule a call or meeting with no commitment.

If we cannot assist you, we will gladly provide you with referrals.

Why Create a Life Estate?

Creating a life estate can have significant benefits for a family. The most common reason for creating a life estate is to avoid the probate of your estate upon your death. Another common cause would be to reduce your assets for Medicaid planning purposes.

Life Estates for Estate Planning

Life estates are a commonly used tool for estate planning. There are many reasons a person might use a life estate to avoid probate. One reason is the property can remain in the control of the grantor until their death.

Since the IRS considers property you retitle as a life estate as remaining under your control, that asset would be included in your taxable estate for estate tax purposes, but would also receive a step-up in basis to the property’s fair market value at the time of your death.

If the property had just been outright transferred to the person without a life estate being retained, then the IRS considers that a completed gift at the time of the transfer. As a gift, the basis you had in the property would be the same basis the person you gave it to would have, so they do not receive the benefit of the stepped-up basis and your child or other recipient of the property could have to pay significant additional taxes

That could have been avoided simply by using a life estate deed. Due to the high estate tax deduction, few people are subject to estate taxes, so the income tax benefits are generally not offset by estate taxes.

Because the property will be transferred directly to the remainder beneficiary under the property’s title, Maryland does not consider this a probate asset. As a non-probate asset, the house will not need to pass through the probate process.

You may be able to completely avoid probate by using a life estate deed if you have no other probate assets or other need to open the estate. Even if you have other probate assets, it may now qualify as a small estate for probate in Maryland.

The remainder beneficiaries would be able to sell, lease, occupy, refinance, or take any other actions necessary for the property as its owners. This contrasts with what would occur if the house needs to go through the probate process. In probate, they would have to wait for approval of the personal representative, the orphan’s court, or for the conclusion of the probate process in Maryland.

Medicaid Planning

When planning for Medicaid eligibility, a life estate deed can be a useful tool for a Maryland elder law attorney. By protecting your home, it will allow you to stay in your home longer but take the ownership of the home out of the calculation of your Medicaid estate for long-term case eligibility.

To qualify for Medicaid in Maryland, you need to reduce your assets to under a minimal amount before becoming eligible for benefits. Further transfers and reductions in assets may be needed to meet the Medicaid legal requirements, but transferring ownership of your home would reduce your estate by a significant amount.

To not be included in your Medicaid estate, the life estate will need to be “without power,” which will be discussed in the next section. Transferring a life estate deed to your heirs on the eve of needing long-term care will not eliminate that asset from your Medicaid estate.

Medicaid has a five-year look back period, so any gifts made during the five years prior to applying for Medicaid long-term care will remain in your Medicaid estate calculations during that period. In any case, transferring it to a life estate within that five years can still provide some benefits in reducing the amounts due.

What Are the Different Types of Life Estate Deeds?

Life Estate Deed with Full Powers

Life estate deeds with full power allow the grantor of the life estate the choice to change the deed, reclaim all rights to their home, or sell or mortgage the property. They do not need the consent of the remaining beneficiaries to do so. They can revoke the life estate for any reason they choose. The powers can be limited, if you choose, but most will just state that all powers are retained. A life estate deed with powers may sometimes be known as a Lady Bird Deed or as an enhanced life estate deed. If I ever find out why those ridiculous names exist, I’ll let you know.

While having a life estate with powers will usually be the preferred method for most, there are benefits to not having powers.

Life Estate Deed without Powers

A life estate deed without powers in Maryland requires that the remaindermen consent to any changes to the life estate. For example, you will need to get the permission of all those holding a remainder interest in the property to:

Change the remaindermen

Sell the property

Refinance or take out a reverse mortgage on your home

This obviously does not sound very appealing unless you are confident your children, grandchildren, and others named would be willing to consent to your request. So, why would anyone want a life estate deed without powers?

There are several instances when you may want a life estate deed without powers. If you wish to reduce your assets for Medicaid purposes, you will need to use a life estate deed without powers. Medicaid does not consider life estate deeds with powers to be a transfer and considers you to still be its owner.

Another instance may be if you fear someone may use their influence as you age to make you change your beneficiaries to their liking. Since all persons must consent to the change, that will stop the greedy caregiver or family member from taking advantage of your declining abilities. Sadly, this is not an uncommon fear and usually caused by having one or more hostile family members.

How to Create a Life Estate

Of course, prior to creating a life estate deed, you will want to consult with a Maryland estate attorney to decide whether it is appropriate for your situation. While this article may have caused you to think it’s exactly what you need, an attorney would be able to consider the big picture. They will decide whether taxes, your general estate planning needs, the type of property, your age, and your family situation make it a good choice or a horrible one.

If there is to be more than one remainder beneficiary, you will want to decide whether they should own the property as tenants in common or own the property jointly with rights of survivorship. Your lawyer should be able to guide you on the proper titling of the property.

Once determined you should have a life estate deed on your property and the legal language to be included in your deed, your Maryland estate attorney will draft the deed.

You will then review and sign the deed before a notary, and the attorney will arrange for it to be filed in the Maryland land records.

Potential Problems with a Life Estate

Selling Property with a Life Estate

One of the more common issues is what would happen if you decided to sell the property before your death. If the home is your primary residence, then you would normally not have to worry about taxes from capital gains on its sale. However, the IRS will consider a part of the property to be owned by the remaindermen, who may not be able to escape taxes though that exemption.

If the property is held by a life estate deed without powers, you may not be able to sell the property at all if those holding the remainder interests refuse to consent to your requests.

Recordation and Transfer Taxes

Most remainder beneficiaries are the children or grandchildren of the grantor and life tenant. As a result, Maryland recordation and transfer taxes usually will not apply to these transfers, since Maryland tax exemptions for descendants apply.

In some circumstances, however, it may be transferred to an unrelated person or a related person not covered by the exception. For instance, Maryland doesn’t have an exception from recordation and transfer taxes for a transfer from an aunt to a nephew and the tax could apply.

Even so, recordation and transfer taxes may be minimal compared to the expenses of probate or other considerations. So, even if the taxes must be paid, often the benefits of the life estate deed may still be substantial.

Will Your Family Cooperate after Your Death?

Because those persons you name as remaindermen immediately become the owners of the property, they could be at each other’s mercy as to how the property will be maintained, whether they will all contribute their share toward property taxes, whether they want to continue to hold the property at all or sell it for valid reasons.

For example, if you have your three sons become owners of hunting land in Garrett County, but only one used it and only one could reliably pay for upkeep and taxes, then that third son might want out of the property as soon as possible. If the others refuse, then the third son’s only way to exit would be to file with a Maryland court. They would request the court to partition the property and for the sale of their interests. Thereafter, Thanksgiving dinner will be a bit awkward.

Other alternatives exist through trusts or the proper drafting of a last will and testament by a Maryland estate attorney that could have avoided that disaster.

Common Questions about Life Estate Deeds:

Is it better to use a trust or a life estate deed?

Both trusts and life estate deeds can help avoid probate, but each has its own purpose and limitations.

While life estates can be a quick and easy solution, it’s limited to that single asset. It also does not allow for more than very basic planning. Once you have discussed your issues with a Maryland attorney, they may identify bad results a life estate deed would cause.

Maryland Trusts allow you to plan for taxes, successive beneficiaries, time-released benefits, beneficiaries with special needs, and a host of other features a life estate cannot provide.

Do I need to file the life estate deed?

Your Maryland attorney will usually file the life estate deed on your behalf. A life estate deed should never just be thrown into your desk to be filed at a later date. Even if the deed is effective, it raises significant questions on whether you intend to finalize the deed, whether there were conditions still to be fulfilled before it was effective, and lots and lots of attorneys fees.

Recording the notarized life estate deed with your county’s land records office would resolve those issues and will put third parties on notice that the property interests exist.

MD Real Prop Code § 3-201

Where is a life estate deed in Maryland filed?

We file your life estate deed in the land records of the county in which the property is located. So, if your property is in Nottingham, then we will file your life estate deed with Baltimore County land records in Towson, Maryland. If your property is Smithsburg then we will file your life estate deed with Washington County land records in Hagerstown, Maryland.

Can I change a life estate deed in Maryland?

If you are the grantor of the life estate deed, then you may sometimes amend the terms of the life estate deed or even revoke it. But, to do so without the consent of the remainder beneficiaries, your lawyer must have drafted the deed as a “life estate with powers.” If the deed is a life estate without powers, then all remainder beneficiaries will need to consent to any changes.

How do I terminate a life estate?

To terminate a life estate, you will need to have been the grantor of the life estate, i.e. the person who formed it. The grantor must have drafted the deed “with powers” to be able to terminate the life estate deed without the consent of the remainder beneficiaries. If the deed was “without powers” the remainder beneficiaries must consent to terminating the life estate.

After the death of the life tenants, those who had the right to use the property while alive, the life estate will automatically terminate and the remainder beneficiaries will become the property’s full owners.

Can I put a life estate deed on a property with a mortgage?

You can put a life estate deed on a property with a mortgage or deed of trust, but there are some things to consider.

If the property is subject to a deed of trust, then it’s possible there is a “due on sale” clause in the deed of trust. If there is a due on sale clause, then a transfer would mean the lender can call the loan for payment. Of course, many ignore this and do it anyway. They figure that if the lender is being paid, then they will likely never raise the issue. It should at least be some consideration during your decision.

The placement of the life estate deed on a mortgage property does not relieve you or your remainder beneficiary’s duty’s under that deed of trust. So, if you owned money on the property and transfer it to a remainder beneficiary by a life estate deed, then the lender can still enforce their interests against the property.

While the remainder beneficiary does not become personally liable for the loan, the property could still be taken.

Can I create my own life estate deed?

Sure, you can. But the learning curve will be very steep and the consequences can be great incredibly bad if you mess it up. As you can see from the article above, there is not just one type of life estate deed, and you will be changing the title on your biggest asset.

Plus, not only are you dipping your toes into changing land records, but you are also having to consider estate planning law, tax law, elder law, and countless other legal considerations.

You will need to title it properly for your residual beneficiaries and doing so improperly could cause grandchildren to lose their inheritance. When the property is eventually sold, an unclear title could cause your sale to fall through while the title company tries to resolve the issue. So, sure, you can. But whether you should is a completely different story.

What is an enhanced life estate deed?

An enhanced life estate deed is a fancy schmancy way of saying a life estate deed with powers, as described above. The grantor of the life estate deed retains the power of change the life estate deed. We are not that fancy and charge extra if you want it to be called an enhanced life estate deed and double that surcharge if you want it to be called a Lady Bird Deed.

Does Maryland have a Transfer on Death deed?

Maryland has a type of deed similar to a Transfer on Death known as a life estate deed. A Maryland life estate deed functions so the life tenant can use the property until their death. At that time, the remainder beneficiaries become the exclusive owners of the property.

TESTIMONIALS