Guide to Maryland Trusts

Using Trusts to Create Your Legacy

Maryland Trust Attorney: How Do Trusts Work in Maryland

Why do people form trusts? The short answer is, for many reasons. Trusts are useful tools to protect you, your assets, and your loved ones from many different issues. A Maryland Trust Attorney can use trusts to:

- reduce taxes;

- preserve assets for multiple generations;

- benefit disabled children while allowing government benefits, such as Medicaid and SSI;

- maintain the privacy of the family; and,

- allow a smooth transition from you to your beneficiaries.

Countless factors determine what type of trust to use and its specific terms. This guide will show you how trusts work, the types of trusts available, the documents and people involved with a trust, and the advantages and disadvantages of trusts.

How do trusts work in Maryland?

Without getting into lawyer talk, a trust is an entity you can form to hold property to benefit you and others. The person you name as the trustee manages the trust. Your trust agreement tells the trustee how to manage and distribute the assets of the trust. While there are many types of trusts, all trusts have the above in common.

A trust is a separate legal person from the person who forms it. It can own property in the name of the trust. It can pay taxes separate from both the person who formed the trust and those who benefit from it. The trust agreement determines how long the trust will remain in place. You can form a trust so it terminates quickly, or you can form a trust that’s built to remain in place for many generations. You can form a trust so you can freely end it, or you can form it so it cannot terminate without a court order. There are few rules limiting how trusts can be used and when it comes to trusts compared to how many ways they can vary.

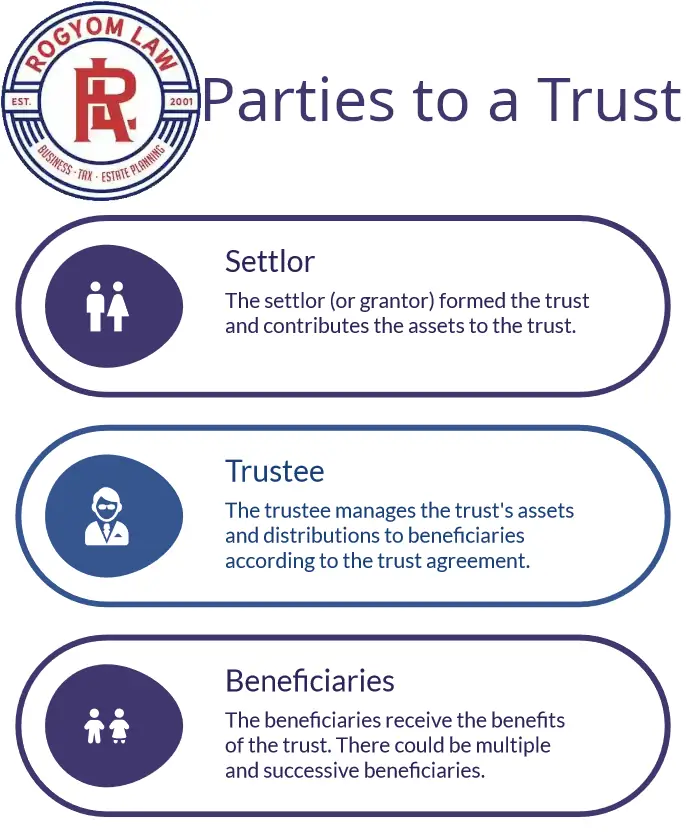

Trusts always have at least the following three persons involved:

- Settlor – This is a person who formed the trust. They likely are also the person who was the source of the funds of the trust. The Settlor may also be known as the Grantor or Trustor.

- Trustee – This is a person who manages the operation of the trust. If the trust agreement allows someone to make decisions on the trust’s behalf, then the trustee usually makes those decisions. For instance, the trustee controls investment decisions.

- Beneficiary – As the name implies, this is a person who receives the benefits of the trust. The trust will distribute assets to this person or on their behalf.

There could be more than one settlor, trustee, or beneficiary and the trustees and beneficiaries may change over time. Additional roles could be a Trust Protector. A trust protector can be given the ability to change the trust agreement or change trustees without court approval. A trust protector may not be common, but a trust protector sometimes can be advisable or necessary.

Unlike business entities, such as a corporation or an LLC, a trust usually does not provide limited liability. So, owning a business through a trust usually does not prevent someone from suing the true owner of the business. But a trust may still provide substantial asset protection in some circumstances.

In short, trusts are incredibly flexible legal tools that can provide benefits not available by any other means. On the other hand, trusts do have their limitations and it’s up to the people forming it to know what type of trust to form and the terms in the trust agreement.

Ready to get started? We’re Ready to Help.

Contact us now and we’ll be happy to schedule a call or meeting with no commitment.

If we cannot assist you, we will gladly provide you with referrals.

Common Uses of a Maryland Trust

Trusts can be useful in many situations. Despite common thoughts, you do not need to be on a Forbes magazine list for a reason to form a trust. Maryland trust attorneys form most trusts for purposes unrelated to estate tax planning. Those trusts generally address the family’s specific concerns or goals. A trust may be the only way to address those issues. Most estate and trust attorneys create trusts to deal with the following common issues and goals:

Maryland Estate Planning

Trusts can be a powerful legal tool for estate planning because they do not need to be limited to one initial beneficiary. It can benefit multiple beneficiaries over time. For instance, it could use its assets to provide for your spouse first, then your children, then your grandchildren. In contrast, a last will and testament distributes assets immediately to your heirs. Once distributed, you have no control over how the heir uses those assets. The heir could waste the assets or lose them to creditors.

You can use trusts to avoid those issues of estate law. It also allows the family to avoid probate, avoid the costs of probate, and avoid your family’s finances becoming public records. Of course, you can sometimes use trusts to reduce taxes.

Trusts for Children and Young Adults

Trusts for children are likely the most popular reason for including a trust in Maryland estate planning. For estate planning, young can mean anyone who does not yet have gray hair. Trustees obviously should hold money on behalf of minor children, but most also realize the legal age of majority is rarely the age of maturity. You can usually expect young adults to make many mistakes before becoming settled. It is usually in the best interests of the child to hold portions of the trust’s assets until much later.

The trustee can use trust assets to support the young person before final distributions. Similar to a helpful parent or grandparent, the trustee may pay for education, food, healthcare, and similar expenses. The trust may hold the remaining assets until you believe it’s time to begin releasing assets without conditions.

Trusts for Children with Disabilities

The disabled face many challenges in their life, including financial challenges. As such, families like to assist disabled family members, particularly if they cannot work and depend on government assistance. They want to provide financial assistance but do not want to jeopardize their government benefits.

Properly drafted and administered Special Needs Trusts will not prevent disabled persons from receiving SSI, Medicaid, and similar benefits.

Trusts for Beneficiaries with Drug Problems and Other Issues

The more you work with families, the more you realize every family has a member with issues. Giving them money can be the most damaging thing you can do to them. They may be in troubled relationships, have trouble handling money, or more serious issues, like an addiction.

Trusts work by delaying or stopping payments if needed to protect the beneficiary. This can keep the assets out of the reach of the beneficiary’s creditors, spouse, or bad habits.

The above, or a combination of the above, are the most common reasons families use trusts.

Main types of trusts:

Despite the many uses of trusts, you can sort all into a few categories. It is possible to use any of these trusts to accomplish the same goals. Other goals may require a particular type of trust. Your Maryland trust attorney will guide you to the correct trust for your situation. Below is a brief discussion of each:

Maryland Revocable Living Trusts

The settlor can always modify or terminate a Maryland revocable living trust. So, the settlor can change the trust agreement’s beneficiaries, distributions, or reclaim the trust assets. This may be useful, for example, if:

- You later decide to sell the main asset of a revocable trust

- Your financial situation or goals change

- Your beneficiary’s creditor, marital, or health changes

- Your beneficiary joins a cult (or quits yours) and you want to change beneficiaries

Some Maryland estate and trust attorneys call revocable trusts a living trust or a revocable living trust, depending on how confusing they want to be. Most people form revocable trusts to:

- Avoid probate

- Keep family matters secret

- Avoid dividing a business or real estate

- Distribute assets after they die to family

Unlike a testamentary trust, you form revocable trusts during your life. It remains revocable while you are alive. After your death, it can no longer be modified or terminated. But, during your lifetime, you may have decided to distribute all assets immediately after your death or that the trust will distribute assets over an extended time. The trust no longer being revocable does not mean it’s indefinite.

Revocable trusts are ineffective for estate tax planning. The IRS considers property transfers to a revocable trust to be incomplete gifts to your beneficiaries. The IRS considers your right to reclaim the asset to be a continuing interest. IRS Regulation 26 CFR § 25.2511-2 states that if you have not ended your dominion and control of the asset, you remain its owner. When you pass away, the IRS will include the asset for estate tax purposes.

This eliminates your ability to use revocable trusts to reduce estate taxes by transferring assets before they fully appreciate, thereby “freezing” their value when transferred. Maryland Estate and Trust Attorneys commonly use asset freezing techniques to reduce estate taxes.

However, assets of a revocable trust do receive a step-up in basis because the IRS includes the property for estate tax purposes. This step-up in basis may significantly reduce the beneficiary’s income taxes upon its sale. Most families are exempt from estate taxes nowadays, so the income tax benefit of a stepped-up basis makes revocable trusts attractive for families without estate tax concerns.

Maryland Irrevocable Trusts

The trust settlor cannot revoke or modify an irrevocable trust once it is formed. Maryland trust attorneys use irrevocable trusts to address more complicated issues, rather than just avoiding probate. While the irrevocable trust may not be modified or revoked except under certain circumstances, this does not mean you will have completely lost control of the assets of the trust. You choose the trustee of the trust and maintain some control through that choice.

Irrevocable trusts are most often used when federal or state laws require you have given up your right to reclaim or otherwise control the assets. Maryland Estate Attorneys use irrevocable trusts for the following types of trusts:

Special Needs Trusts – In circumstances where the person who is disabled receives assets that jeopardize their benefits, they will need to form a first-person special needs trust to reduce their assets. The required type of special needs trust is also known as a (d)(4)(A) trust, referencing a federal code section. Among other requirements, a self-settled special needs trust of this type must be irrevocable, must have an independent trustee, and must limit access to the funds.

Estate Tax Planning – For an asset to be considered not part of your estate at the time of your death, you must have given up control of the asset at an earlier time. A transfer that you can take back or have a right to use, such as a life estate over real property, will cause the transfer to be considered an incomplete gift or transfer. Once out of your estate, any further appreciation will not be included as subject to either estate or gift taxes, thereby reducing your total tax burden.

If estate taxes are not a concern for your family, terms can be included in the irrevocable trust agreement allowing the transfer to be considered having been completed for legal purposes but not complete for estate and gift tax purposes, thereby allowing a step up in the assets’ basis for income tax purposes.

Asset Protection – Losing the ability to reclaim assets is a prerequisite for preventing creditors from seizing those assets. There are many other requirements as well. The timing of the transfers, the debtor not having control of the trust, and the applicable state’s laws can also affect the trust’s ability to avoid creditor claims.

Income Tax Planning – By transferring the assets to an irrevocable trust, the income from those assets can be shifted to family members that are in lower tax brackets. If this is not desired, then it is also possible to have the income taxes pass to the settlor by including provisions to be an effective transfer for estate taxes but not for income taxes.

Elder Law Planning – Irrevocable trusts are used for elder law purposes since the settlor’s assets need to be reduced to qualify for Medicaid long-term care benefits. Medicaid considers the assets having been gifted or transferred and no longer part of the settlor’s assets for Medicaid purposes after the passing of five years.

Life Insurance Trusts – Planning can be used so life insurance proceeds are not included in the taxable estate by transferring a life insurance policy or having the trust purchase the life insurance policy. You would have your financial advisor title the life insurance policy to the trust. This type of trust is common enough to be known as an Irrevocable Life Insurance Trust or by its acronym, an ILIT.

Testamentary Trusts for Estate Planning

While a living trust is any trust formed during the lifetime of the settlor, the settlor does not form a Maryland testamentary trust until the settlor’s death.

The last will and testament of the settlor includes the formation of a trust. The last will and testament includes bequests to at least the initial beneficiaries. It will then provide some criteria used to determine if the bequest will go directly to the beneficiary or be put into a trust. The criteria will often be the age of the beneficiary.

Terms similar to those you find in a normal trust agreement will be inserted into the last will and testament. The terms will name a trustee and provide the trustee with instructions on how to manage the trust and when distributions from the trust should be made.

Not all testamentary trust assets will need to come from the estate of the settlor and non-probate assets, such as life insurance proceeds, bank accounts, and other assets that can be passed through beneficiary designations can name the testamentary trust as the destination for the assets upon your death.

Even if there are no probate assets that would require the opening of the succession, for the testamentary trust to be formed the last will and testament will need to go through the probate process for the trust to be recognized.

The most common testamentary trusts you will find are bypass or marital trusts and trusts intended to benefit children, grandchildren, and other younger persons inheriting under the last will and testament.

Funded or Unfunded Living Trust

Living trusts can be funded or unfunded. You fund the trust by transferring your property into it. Whether a living trust is funded or unfunded often depends upon the source of the assets. When you form a trust there is no need to immediately fund it. You can establish the trust with the intention it will receive funds at a later date, such as upon the payment of life insurance proceeds. In such case, the last will and testament or the life insurance policy’s beneficiary designation form will name the trust as the recipient of the funds.

If the trust is funded, there could be income tax requirements since the trust will have assets and related income being produced in the trust. Using an unfunded trust to receive the proceeds of a last will and testament could also preserve some privacy for the beneficiary. This is because the distribution terms will not be part of a testamentary trust and, thus, will not be in the public record. So, if you do not want people to know the beneficiary will receive a big payday when they turn 30 or if the beneficiary has drug issues addressed by the trust’s terms, then using an unfunded trust would keep those issues private.

Work with a Maryland Trust Attorney

You should work with an experienced Maryland trust attorney for creating and funding your trust. You want to make sure your trust protects your family and your assets. Contact Rogyom Law today for help in forming your trust.

Common Questions Regarding Trusts:

How do I make a trust in Md.?

You create a trust by creating a trust agreement, which will give the terms of the trust, name the trustees, designate the powers and obligations of the trustees, name the beneficiaries, and provide for distributions. In addition, the trust will need to be funded with assets either immediately or at some point in the future.

Who is in charge of a trust?

The trustee is the person responsible for managing the trust. Among the trustee’s responsibilities, the trustee will ensure the terms of the trust agreement are being followed, make sure the assets are being maintained or invested prudently, hire advisors, prepare trust accountings for courts and beneficiaries, determine whether distributions should be made. Essentially, they are the CEO of the trust.

I’m a trust beneficiary. What does that mean?

As a trust beneficiary, you are entitled to receive the benefits of the trust. This may mean income and assets should be distributed to you or the trust agreement may limit your right to receive those benefits. The trustee of the trust may send you a K-1 annually so you can report on your income tax return the trust income the trust generates and distributes. You may also be entitled to demand an accounting from the trustee showing how trust assets are being invested and used.

How do I transfer assets to a revocable trust?

The answer will depend upon the type of asset. You can transfer assets either by an assignment of those assets to the trust or by changing the title to the property. If the asset is real estate, then a new deed to the property will need to be filed in the appropriate county. So, if you own a home in Cockeysville and hunting land outside Williamsport, then you will need to file new deeds with the Baltimore County recordation office in Towson and with the Washington County recordation office in Hagerstown.

TESTIMONIALS