Estate Planning for Real Estate Investors:

Safeguarding Investment Properties

Making sure someone will care for your children

Estate Planning for Real Estate Investors: Safeguarding Investment Properties

All families need to create an estate plan, but this is especially crucial for real estate investors. Families with real estate investment properties need to make the normal estate planning decisions regarding, for example, the normal provisions on distributing assets to their family. If your family has real estate investments, however, you also need to decide how your real estate business and its properties will be managed, protected, and distributed following your death or incapacity.

Understanding the basics of estate planning and the tax and legal matters regarding the ownership of real property will allow you to know your options and understand the suggestions of your Maryland Wills and Estates Attorney. It will also allow you to spot potential tax or legal concerns that may require the help of your estate attorney.

The best estate lawyers will help ensure that you can pass your investment properties to your loved ones seamlessly and according to your wishes. In this blog post, we will explore the fundamentals of estate planning for owners of real estate investment properties, including the importance of having a will or trust in place, the tax implications of your estate planning, the practical concerns to be addressed, and more.

Understanding Estate Planning for Real Estate Investors

Many real estate investors wish for their family to continue to benefit from the properties they accumulated. If your real estate assets have appreciated, your family can benefit from the equity you built. But you may prefer your family to hold the properties, particularly if they create income your family can use. Keeping your real estate empire together and profitable for your family requires some planning by you and your attorney.

Provide a Plan for your Real Estate Investments by Using Trusts and LLC’s

As you know, managing real estate can require time, knowledge, and some business savvy. You may be concerned whether your family members will be up to the task. Depending upon your family, you may need to plan so the correct person or people will be managing the real estate.

Estate planning attorneys regularly use trusts and LLC’s to help with the transfer of assets, to delay the distribution of assets to beneficiaries, and to provide legal protections to your assets and your family. You can also use those trusts and LLC’s to appoint trustees and managers that will be responsible for making decisions regarding the properties after your death.

The person you appoint does not need to be a beneficiary. You could for instance appoint any trusted advisor or friend of the family. Further, you can authorize the trustee or LLC manager to hire a management company to handle the day-to-day issues of the real estate.

Divide Your Real Estate Between Family Members or Keep It Together?

You may have the opportunity to keep the real estate assets together to benefit your family by putting the properties into a trust or putting them all into one LLC. Your family members can then become beneficiaries of the trust or own membership interests in the LLC.

On the other hand, family members and heirs may have different needs. Some may have an immediate need for cash, while others may be happy to continue to get an income from the properties. Some may be capable of managing the real estate, while others may have no time or desire to do so. In these circumstances, you may need to decide how to divide the properties or simply to have the real estate liquidated and cash disbursed.

Ready to get started? We’re Ready to Help.

Contact us now and we’ll be happy to schedule a call or meeting with no commitment.

Asset Protection: Side Benefits for Estate Planners

Some of the steps taken in planning your estate can also create asset protection for your family. You may be setting up LLC’s and revocable living trusts as part of your estate planning. These estate planning tools can also be used to protect your assets after you pass away from both your creditors and your beneficiaries’ creditors.

If you have personal concerns that make you believe you need asset protection for yourself, then additional steps will likely be needed to protect your assets from your own creditors.

Blended Families: Estate Planning for Rental and Real Property Investments

If you have children from more than one marriage, you can consider having the properties divided between the two sets of children. You can then determine whether either set of properties should be held in trusts, distributed, or sold.

For instance, I have dealt with blended families where there was a substantial difference in age between the children from a first marriage and the children from a second marriage. The children from the first marriage were mature adults with an interest in owning and managing real estate. The children from the second marriage were children who would have substantial cash needs for their wellbeing and education.

The parent decided he should divide the properties so the older children from the first marriage received the properties that had long-term growth potential but that also required more active management. The second marriage’s younger children would receive the properties capable of being sold immediately at a good price. Each set of children received the properties best suited to their stage in life and needs.

Estate Tax & Income Tax Considerations in Estate Planning for a Real Estate Investor

When you began investing in real estate you likely became familiar with the many tax benefits of owning rental properties. The good news is that you and your family can continue to receive some tax benefits from your real estate, even on your way out. But you and your attorney need to plan correctly for your heirs to receive those benefits.

You likely have some knowledge of the various taxes you can incur when selling a property as a real estate investor. You will need to more fully understand the taxes involved with estate planning, which can include estate taxes, income taxes, and the implications of gifting, selling, and transferring real estate for estate planning purposes. Here are some key considerations:

Estate taxes on your real estate investments, homes, and other assets

The IRS and state governments impose inheritance and estate taxes on assets you transfer at the time of your death. Thankfully, for most investment real estate owners, you will need a very large estate before needing to worry about the federal estate tax. The federal estate tax laws exempt huge amounts of assets.

They doubled the federal estate tax exemption in 2018 to $11,180,000, and it has grown every year since. For several decades, politicians have kept us on our toes by making exemption increases temporary and wondering whether it will increase, decrease, or stay the same. No one knows whether the current law will continue past 2025 so you should consider regularly updating your estate plan.

Therefore, even families with larger estates that are currently exempt should keep an eye on tax law changes. You should stay in touch with your estate attorney since you may want to amend your estate plan if the exemption amount changes.

The IRS determines the estate tax amount due based upon your estate’s value at the time of your death. You will probably be required to give evidence of your estate’s value, so your heirs may need to appraise your estate’s assets, particularly real estate.

To minimize estate taxes on investment properties:

- Consider using trusts as mentioned earlier.

- Make use of annual gift tax exclusions to transfer some real estate during your lifetime.

Income Tax Considerations for a Real Estate Investor’s Estate Plan

Besides estate taxes, real estate investors need to consider income taxes when making decisions on their investment properties later in life. Trying to minimize estate taxes can cause your family’s income taxes to increase. So, it’s often important to consider both when making your estate planning decisions.

Selling real estate can always create taxable income, but you and your family have some tax benefits available when a family member passes away that can reduce or eliminate the income taxes. You will want to take into account those benefits when deciding upon the the best estate plan.

Since you may not be too familiar, the following are some basic income tax rules that affect real estate investors and their estates.

- Capital Gains Taxes: When a real estate investor sells a property, they generally have income taxes called capital gains. The IRS generally allows assets that appreciate in value to be taxed as capital gains. You determine how much capital gains income you received from the sale of a capital asset by subtracting the adjusted basis in the property from the selling price. If you hold the asset for more than one year, then the capital gains rate will be lower than the tax rate you normally would pay, for example, income from your employment.

- Adjusted Basis: Your adjusted basis for the real estate would be the price you paid to purchase the property, plus the amounts you paid for improvements and repairs, minus the amount you depreciated the property by over the years.

- Depreciation Recapture: Investing in real estate comes with the added benefit of substantial tax benefits. When you depreciate your real estate, you must track and report all the depreciation you have taken. You will also be required to reduce the property’s adjusted basis for all depreciation taken. When you sell a property you depreciated, then the IRS taxes the gain at the higher ordinary income tax rate to the extent you depreciated it. If the gain exceeds the depreciation, then the IRS taxes that gain at the lower capital gains tax rate. –

- Stepped Up Basis (or step-up in basis): If tax law considers you to be the owner of an asset at death, then a federal tax law readjusts the basis of the property to the fair market value at the time of your death. Since properties usually appreciate in value, adjusting the basis to FMV creates a means there’s a “step-up in basis.” Therefore, the people who inherit your property will not need to pay taxes on the amount the property appreciated during your lifetime. This also eliminates the amount you depreciated the property and the need for depreciation recapture. You need to keep “ownership” of the property until death to get this benefit.

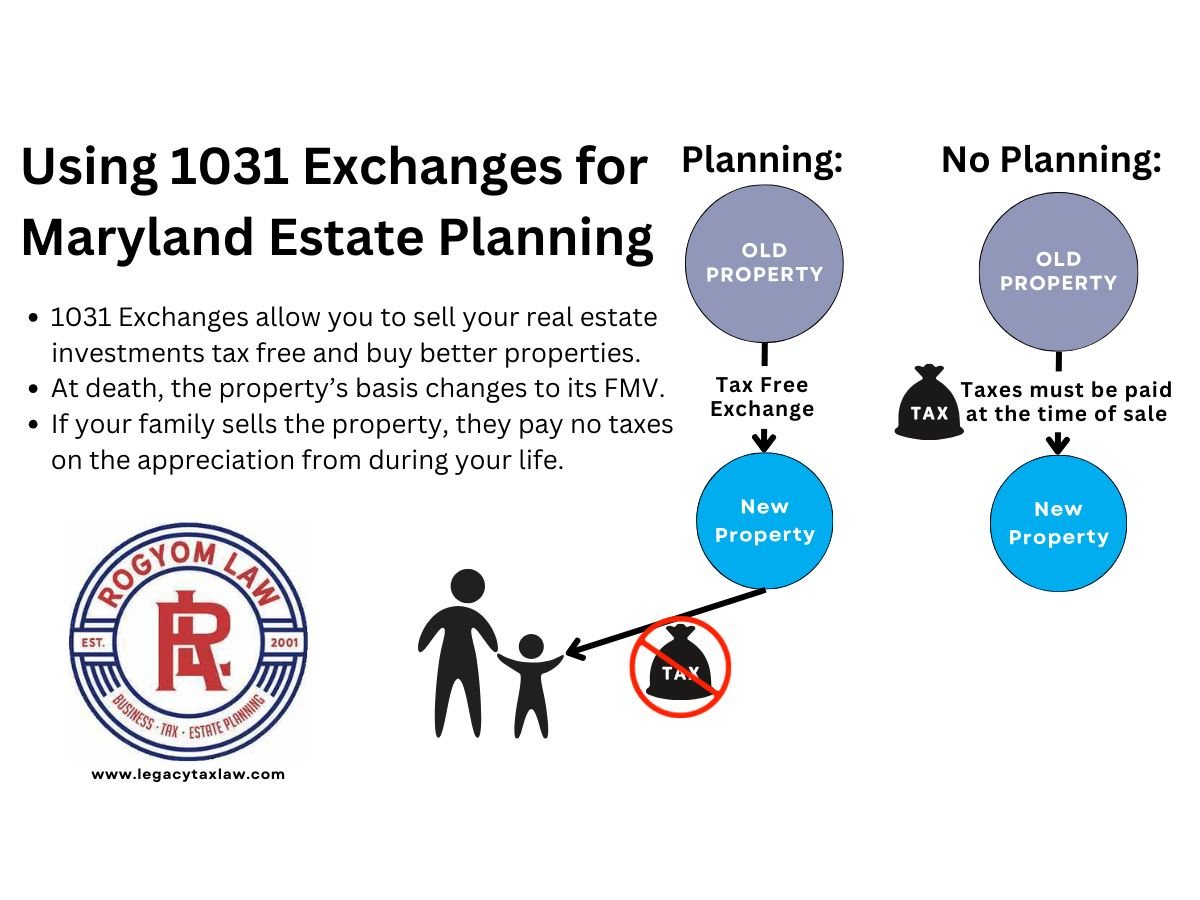

- 1031 Exchange: A 1031 exchange refers to the section of the U.S. Tax Code, Section 1031. It allows you to sell one piece of real estate, and purchase another without having the sale result in capital gains or other income taxes. While there’s a reason to use it throughout your life, this becomes a very important tool in later years. It allows you to defer income taxes, including the capital gains and depreciation recapture. The hope would be that you can defer it long enough that a step-up in basis at your death will eliminate those taxes.

Planning Your Estate for Commercial Investment Properties to Minimize Income and Estate Taxes

You will want a great Maryland estate attorney and your CPA involved in planning your estate if you own real estate or other business interests. The tax consequences of not taking advantage of the benefits available to you can be substantial.

Your estate attorney and CPA will diagnose whether estate taxes are a concern for you, guide you on whether to transfer high basis assets to your heirs by gifting, manage your assets and any investments and choose the right entity for your portfolios of real property and liquid assets, and held you determine which estate planning documents and tools will be the best to use. In addition to the estate tax deduction, you can gift an interest in your assets using the annual gift exclusion. The goals will be to:

- Provide stepped-up basis when possible;

- Minimize estate and transfer taxes;

- Avoid probate; and,

- Allow you to keep control or use of your assets.

Some estate planning options can be a great way to accomplish one or more of those goals, but not so good with others. This is why having a quality Maryland estate planning lawyer can be a tremendous benefit to you and your heirs.

Planning to minimize income taxes has become the dominant factor in estate planning. For example, if you have an appreciated real estate that does not produce sufficient income for your retirement or that requires substantial involvement that you cannot continue in later years. If you sold the property, there could be significant income taxes.

The solution is to use a 1031 exchange to defer income taxes on the property’s sale. You can exchange the property that does not produce enough income and find another real estate asset to replace it. A retired person may choose to replace their current property with other real estate that requires less attention and produces higher monthly cash-flow. Another person may want to replace it with a property they believe they can purchase at a bargain or that can appreciate faster.

You then can plan for that new property in your estate plan. Under the right circumstances, we may be able to both avoid probate and still have you considered the property’s owner for tax purposes. The asset can be eligible for a basis step up at your death by retaining ownership. By using a 1031 exchange and properly planning your estate, you may not only be able to defer the capital gains taxes from selling the property but permanently eliminate them.

Charitable Contributions: Charitable contributions can be an effective strategy for reducing income taxes during an investor’s lifetime. If you incorporate charitable giving into your estate planning, you can receive additional tax benefits while supporting important causes. Establishing charitable remainder trusts or gifting appreciated properties to charitable organizations can be viable options for real estate investors seeking to minimize income taxes as part of their estate plan.

In summary, income tax considerations play a significant role in estate planning for real estate investors. By addressing these considerations proactively, investors can optimize their tax position, minimize tax burdens on their heirs, and ensure a smooth transfer of assets. Consulting with a knowledgeable tax professional or estate planner can provide invaluable guidance in navigating the complexities of income tax considerations in estate planning for real estate investments.

Estate Planning for Bank Loans when Investing in Real Estate

There’s a good chance you will owe money to a bank upon your death if you invest in real estate. You may have taken out that loan to purchase the real estate or refinanced a property for improvements, additional purchases, or to stay liquid. Clients often ask what will happen to those loans and the properties upon their death.

Banks usually include in any loan documents that the loan will be due upon the death of the borrower. The bank will then have the choice on whether to actually collect the loan immediately. They may offer to continue the loan with the family of the borrower under the same or under new loan terms.

The bank will be more likely to extend the loan if:

- The family members have experience with real estate as property owners;

- The family members have good credit ratings, income, and net worth;

- The type of real estate asset would not be difficult to sell if necessary;

- The properties have substantial equity making the loan less risky; and,

- The loan has a limited amount of time remaining.

Nonetheless, banks sometimes seem to act irrationally, and no one can honestly predict what a bank will do. The bank may hold most of the cards on making the loan, but they may not want the risks involved in forcing a sale or a foreclosure of the investments.

Prevent a Bank from Foreclosing through Advanced Financial Planning and Life Insurance

When you refinance your loans you have the opportunity to shop the banks for a loan that will allow your heirs to continue the loan. Typical banking rules will require the heirs to be the property owners of those assets after your death. You can also consider having life insurance in place as part of your estate plan to pay off that loan at death.

Have A Maryland Estate Attorney Provide Planning Options for Your Rental Homes and Other Assets

Many factors need to be considered when preparing an estate plan for a real estate investor. You should have a qualified attorney involved in your estate planning that can make sure your wishes are fulfilled and that can minimize the risks that can jeopardize your life’s work. Since your family situation and the real estate assets you own can change, you will likely want to establish an ongoing relationship with your attorney and your financial advisors.

Commonly Asked Questions for Maryland Estate Planning Lawyers

I’m a property investor with rental properties in Baltimore County. What benefits can my family and I get from estate planning?

With an estate plan a property investor can substantially reduce the taxes you and your family will need to pay. Your family’s wealth can be used to fund your retirement and then passed to the next generation free from taxes.

TESTIMONIALS